Reduce Debt, Reduce Inventory and Don’t Make Promises You Can’t Keep

The specialty chemical sector should prepare because the U.S. economy is headed for a recession. That was a significant takeaway from economist Robert Fry, who spoke to nearly 1,100 SOCMA Show attendees, March 1-3, in Nashville.

Here are his key takeaways from his keynote address:

- The U.S. economy is likely to fall into recession in 2023.

- Recession is necessary to bring inflation down to 2%.

- The faster inflation comes down, the milder the recession.

- A mild winter and bumper crops have cushioned the impact of the Russian invasion of Ukraine on energy and food prices, easing the economic blow to Europe, the Middle East and Africa.

- Chinese growth is at risk from the pandemic, population, and policy.

Fry’s assessment hasn’t changed much in the weeks post-show. But he recently shared additional thoughts with sage advice to the industry in our recent Q&A.

SOCMA: The Fed staff has officially projected a recession for the second half of 2023. Do you agree with their assessment?

Fry: In my presentation at the SOCMA Show, I noted that leading indicators point to a recession. Every recession since 1973 has been preceded by an inverted yield curve and at least a doubling in oil prices. The yield curve had inverted, and with normal lags, that would mean a recession starting in mid-2023. A near-term recession would imply that either bond markets have done the Fed’s work for them, or energy prices caused or hastened a recession.

But most leading indicators, such as stock prices, housing starts/permits, LEI, and my own leading index are pointing to a recession sooner than mid-2023.

So, I think the Fed staff is basically correct regarding their projection, although the recession could start before mid-year and extend into early 2024.

Any arguments against a recession are really arguments for a mild recession:

- Household and corporate balance sheets are still in good shape.

- There is still plenty of pent-up demand for houses and motor vehicles.

- Services, especially travel and entertainment, are still recovering from the pandemic.

- Oil and, especially, natural gas prices have retreated from 2022 highs.

SOCMA: Based on your projections in March, how does May compare? Do you see a change in course?

Fry: The recession might get here a little later than I thought in March, but not by much. The recession is being driven by declines in residential construction and home sales, and in industries that make things that go into houses, either during construction or before or after the sale of an existing home.

SOCMA: How does the pending recession compare to the recession in the 1970s?

Fry: There are similarities and differences from the recession in the 1970s.

Similarities:

- Higher energy prices

- Higher food prices

- Policymakers blame supply shocks for the consequences of THEIR (demand) policies

- High inflation BEFORE food and energy prices spiked

- It will probably take a recession to get inflation down to an acceptable level.

Differences:

- Demographics

- Young adults are inflationary; creating huge demand for housing and motor vehicles. Older adults are more willing to defer spending.

- Globalization

- Free trade reduces inflation, despite some backtracking.

- Fed got serious after one year of high inflation rather than after 13.

- Prices are more flexible now.

SOCMA: What insight can you share regarding economic trends for specialty chemical and commodity chemical demand?

Fry: Demand for chemicals has already turned down. Industrial production for chemicals (excluding pharmaceuticals) peaked in March 2022. After drifting down for several months, it fell sharply in December, probably due to destocking. It bounced back in early 2023, but it was 3.4% lower in March 2023 than in March 2022.

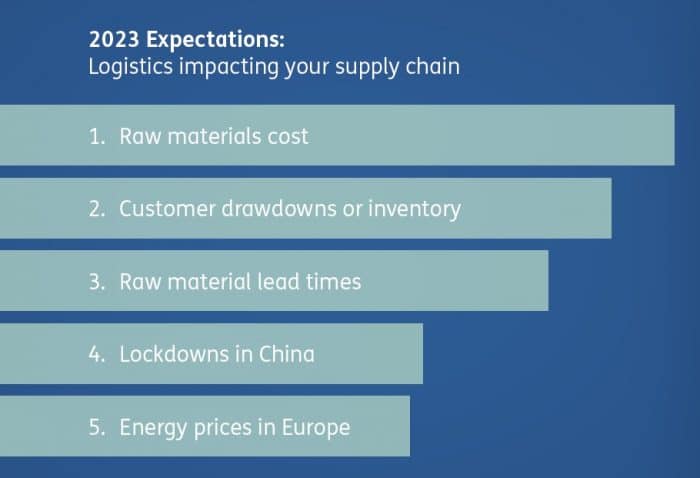

SOCMA: We recently asked specialty chemical companies what would most impact their supply chain. What is your assessment of these findings and categories?

Fry: Natural gas prices have plummeted thanks to a mild winter. That should lower raw material costs and reduce worries about energy prices in Europe. In addition, lockdowns in China are over, at least for now.

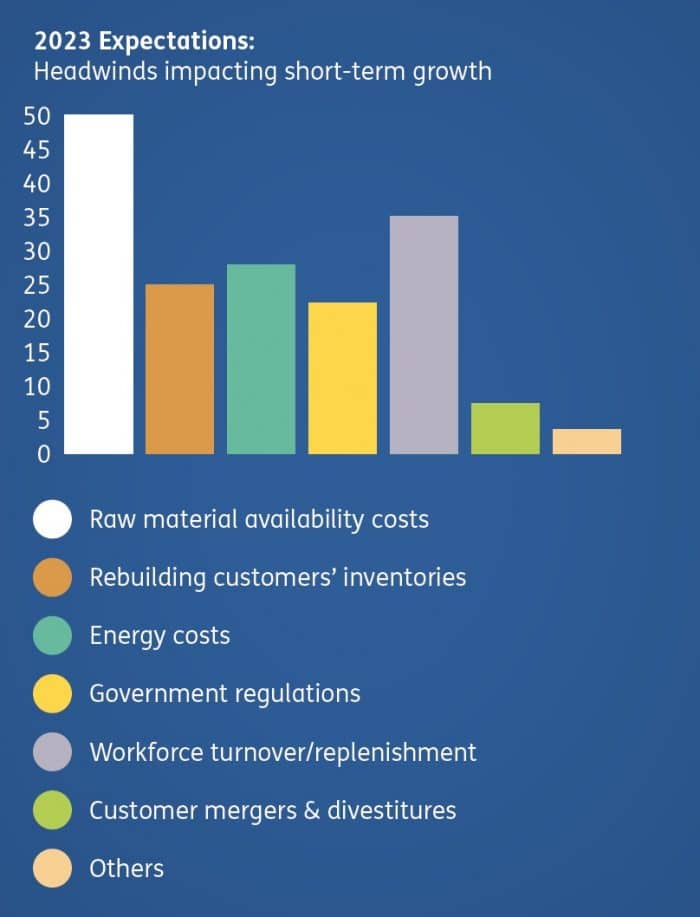

SOCMA: In a recent SOCMA Pulse Poll, raw material costs and soaring energy costs were key headwinds impacting short-term growth. Do you see this holding true?

Fry: I’ve been writing papers on the economic impact of oil and gas prices since I was in high school. I think energy prices are of paramount importance. Not only do they reduce the purchasing power of consumers and the profit margins of producers, but they also have huge psychological impacts. The piece of economic data we see most often is on a big sign along the road; it’s the price of gasoline. Consumer sentiment often perfectly reflects the price of gasoline.

SOCMA: We’ve heard reports that companies in Europe and other offshore countries are seeking out U.S. manufacturers due to continued inflation and rising energy prices in Europe. Is this a trend you are seeing as well? What is your assessment?

Fry: In most of the world, industrial chemicals are made from naphtha, a crude oil derivative. In North America, those chemicals are made from natural gas liquids. When natural gas prices are low relative to oil prices, North American chemical producers have a competitive advantage. With natural gas prices near $2 per million British thermal units (mmbtu) and oil around $80 a barrel (bbl), that advantage is huge.

SOCMA: What is your long-term economic outlook?

Fry: Labor is likely to remain the scarce factor of production.

- Labor shortage is demographics, not just COVID fears and bad policies.

- Seven highest years for US births were 1956-62.

- Reshoring looks increasingly attractive but will be limited.

- Pandemic, geopolitics, and port/shipping constraints argue for moving supply chains out of China and to North America.

- Capital-intensive business can move to US. Labor-intensive business can’t (without major immigration reform).

- Fed has probably learned to go big, but to reverse course sooner.

- Fiscal policy will be constrained by size of debt/deficit.

- Politicians less likely to admit/learn from mistakes than Fed.

SOCMA: If you had one piece of economic advice for specialty chemical manufacturers and the industry, what would that be?

Fry: There are a few things that businesses should do in anticipation of a recession – reduce debt, reduce inventories, avoid making promises (earnings estimates) you can’t keep – but once a recession starts, most responses fall into two categories: mistakes and things you should have done anyway. Minimize the former. Use the recession as motivation to do the latter.

Meet Economist Robert Fry

Only eight days after defending his doctoral dissertation, Robert Fry started his career in September 1984 at Conoco, which was owned by DuPont at the time.

“After a few years at Conoco, mostly doing tax policy analysis, I moved to the DuPont Economist’s Office, where I did economic forecasting and analysis,” Fry said. “Except for a two-year stint with DuPont’s Pension Fund, I was there for the next 28 years.”

From January 1995 until he retired from DuPont in June 2015, Fry wrote a monthly newsletter on the economy and gave speeches on the economic outlook to business teams, DuPont customers and trade associations. Since starting his own company in 2015, Fry continues to offer valuable economic analysis through these platforms.

So what has been Fry’s biggest accomplishment as an entrepreneur and economist? “My biggest accomplishment as an entrepreneur is starting a viable business that allows me to do the parts of my corporate job that I liked best (and get paid for them),” he said. “I’d love to have more newsletter subscribers and speaking gigs, but I’m doing something I enjoy that I can continue to do for many years. As an economist, I’m proud to have been named a NABE Fellow by the National Association for Business Economics in 2018 and to have won the 2022 NABE Outlook Award ‘as the most accurate macroeconomic forecaster for the year ending June 2022.’”

Categorized in: Uncategorized