Q2 2024 SOCMA Pulse Poll Provides Industry Snapshot

June 10, 2024

Arlington, VA – In mid-May, SOCMA conducted its quarterly commercial pulse poll, which provides a snapshot on the state of specialty chemical manufacturing and additional benchmarking data for SOCMA Members. Respondents of the Q2 Pulse Poll continue to show cautious optimism for the remainder of 2024.

Takeaways:

- Companies show higher levels of growth, with more focused effort into new market exploration and expansion.

- Increasing demand signals inventory drawdown has decreased since last year.

- Customers, including the U.S. Government, are building supply chain resilience through onshoring and nearshoring projects.

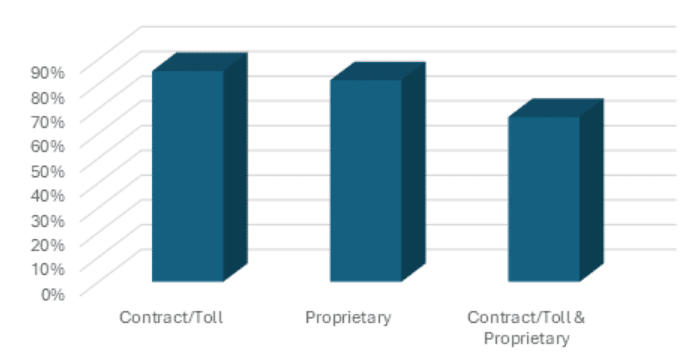

Manufacturing Type

Respondents to the Q2 Pulse Poll were almost evenly divided among contract/toll manufacturers, proprietary product manufacturers, and those engaged in both. A higher number of companies than expected conduct both contract/toll manufacturing and proprietary products. SOCMA outreach confirm companies are diversifying through either acquisitions and organic growth based on individual market conditions and competition.

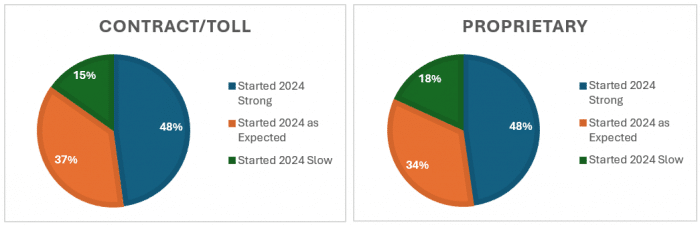

2024 Projections & Growth

For both toll/contract and proprietary manufacturers responding to the pulse poll, 2024 started strong, or as expected, with around 15+ percent for both categories sharing that the year started off slow. It is not surprising that approximately 50% of respondents started 2024 strong and 35% as expected. The report mirrors the in-person conversations at the 2024 SOCMA Show in Nashville, TN. Based on Q4 anecdotal information, SOCMA members were cautiously optimistic at the end of 2023 and were hopeful 2024 would be a better year.

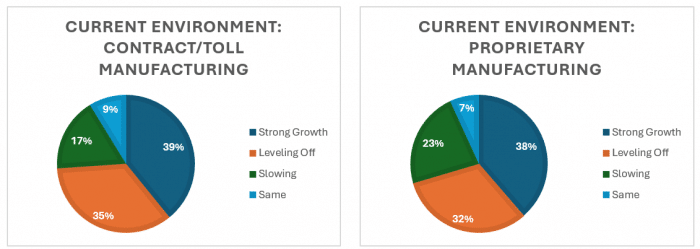

The 2024 SOCMA Contract Manufacturing Outlook foresaw a partial rebound coming in 2024. Nearly 40% of companies project continued growth in contract manufacturing and proprietary manufacturing through 2024, compared to the same period in 2023 when companies only projected 17% growth in contract/toll and 14% growth for proprietary. Decreased projects of growth in Q2 are attributed to either projects being slow to come in or being pushed down the calendar, leading to a conservative and protective mindset about the remainder of the year. However, a strong Q1 provided additional cash flow for 2024 should they be exposed to a slow down.

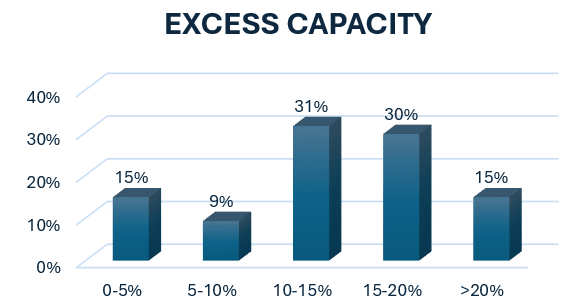

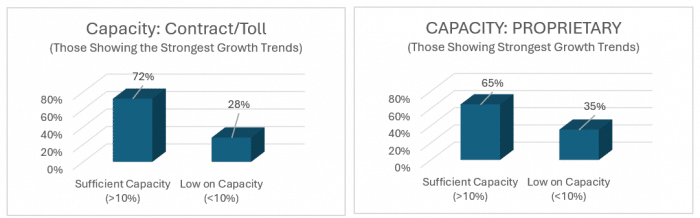

Capacity Excess & Constraints

Specialty chemical manufacturers have available capacity for projects, but nearly a quarter are signaling that capacity is very tight (<10% availability). There are multiple factors with capacity. Capacity availability is not indicative of lack of sector growth.

For companies that have both proprietary and contract/tolling capabilities, some have indicated that there’s more opportunity for growth in contract/toll manufacturing. Some have reached their ceiling with the growth of their proprietary products and are looking to increase their market share in the contract/tolling space.

Workforce constraints to support the workload may limit specialty chemical manufacturers from undertaking projects. Companies have reported the need to increase their workforce by 20% by the end of the 2024 fiscal year and some as much as 50% to meet growth goals in the next 5 years. The National Association of Manufacturing reports 3.8 million manufacturing jobs will be needed by 2033 and more than 1 million will be left unfilled.

The two graphs above show the tightening more specifically to toll/contract manufacturing vs. proprietary manufacturing. There is less capacity for proprietary production than for contract/toll production. Again, this tightening in the industry will trigger the need for more capacity. Depending on the specific company, the capacity needs could trigger CapEx, or it could change operating hours, i.e. increase from 24/5 to 24/7.

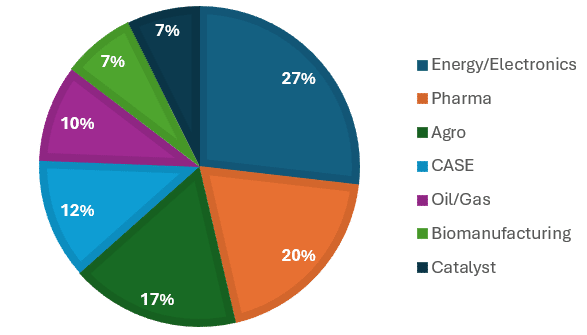

Most Active Market Segments

Energy/Electronics, Pharma, Agro and CASE (coatings, adhesives, sealants and elastomers), make up 76% of the most active market segments. They are all critical chemicals and included in the mega trends our members and industry are closely following.

Specialty chemical manufacturing is vital to the CHIPS Act, wind solar, and other energy efficiency and sustainability efforts. U.S. manufacturers play a significant role in the pharma and agro industries, where we saw gaps and shortages during and since the pandemic. The focus on securing the domestic supply chain comes coincides with climate concerns for crop life protection and demand on food supply.

Most Interesting Points

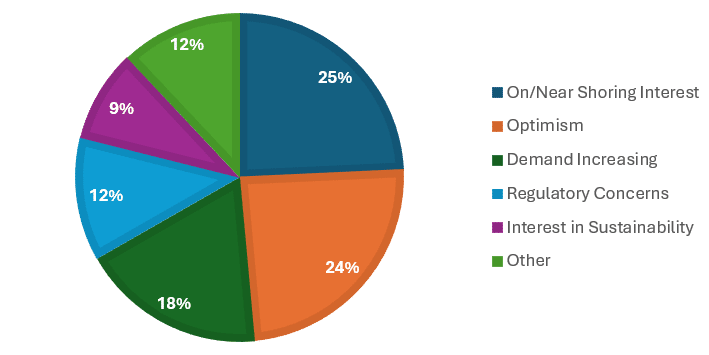

Companies See an Uptick in On/Near Shoring Projects and High Levels of Optimism Despite Regulatory Concerns

U.S. manufacturing continues to see signals of growth through on/near shoring to secure the domestic chemical supply chain, which the pandemic exposed as a critical gap.

In February, 14% of respondents reported they were actively pursuing onshoring related projects. Comparatively, nearly 25% of respondents are working with customers to pursue on/near shoring projects.

As indicated in SOCMA’s 2024 Contract Manufacturing Outlook, while customers are always looking for a smart cost model, supply chain dependability and reliability coupled with quality, customization and technical expertise are valuable considerations for U.S. suppliers.

The regulatory environment continues to be a concern and poses obstacles to some of the very programs the Administration has implemented that could return business to the U.S. Federal agencies are working diligently to pass regulations, and the chemical industry is feeling the brunt of that effort. Despite this, there continues to be industry optimism for U.S. manufacturing.

About the SOCMA Pulse Poll

The SOCMA Pulse Poll is an initiative of the SOCMA’s Commercial Pillar. SOCMA polls the industry to obtain a real-time lens into trends impacting business growth across the specialty chemicals industry. The data is used to drive SOCMA’s commercial service programs and lead generation tools. The Q2 2024 received responses from 60% of SOCMA Member Manufacturers.

About SOCMA

The Society of Chemical Manufacturers & Affiliates (SOCMA) is the only U.S. based trade association solely dedicated to batch manufacturing in the specialty and fine chemicals sector. Founded in 1921, SOCMA supports and fosters growth within the specialty chemical industry and by delivery legislative and regulatory advocacy, promoting the highest levels of safety, and strengthening business intelligence and manufacturing operations. Our members plan an indispensable role in the global chemical supply chain, providing specialty materials to companies in markets ranging from consumer products and electronics to pharmaceuticals and agriculture.

Contact Us

For more information, or to speak with a member of our team about this data, contact Joe Dettinger, VP, Manufacturing & Commercial Programs.

Categorized in: Commercial